What is your biggest travel money mistake? What would you have done differently while traveling if you had the chance?

Me? A few things. I regret keeping a stash of money in my passport wallet. When my passport was stolen, so too was my emergency stash. (Now, I diversify my cash I have so I never lose it all).

#1 Paying the Foreigner’s Fee

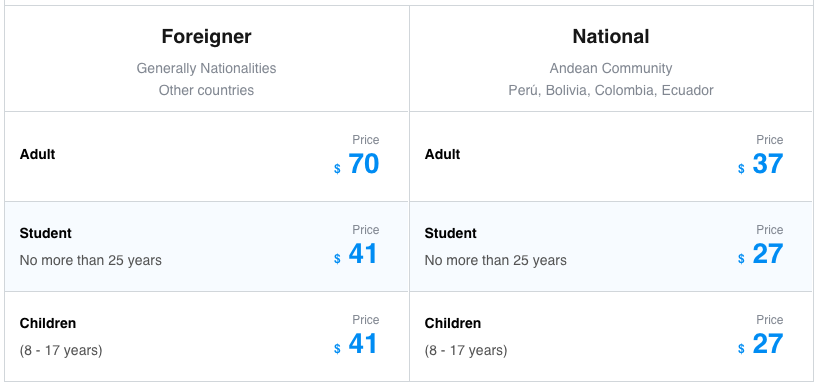

For certain experiences, such as seeing monuments, landmarks, and sightseeing, some countries will charge a foreigners price which is usually significantly more than the ticket for a resident. We knew this heading in and could not negotiate the cost.

For example, I paid $70 USD to climb Machu Picchu, while residents only pay $37.

A lot of monuments and landmarks in Mumbai, India and Paris, France also had foreigner prices and free admission for locals.

If you’re a student, you will need to research and register ahead of time to benefit from most international student discount programs.

At marketplaces, you have an opportunity to haggle. Vendors will start at a high price for foreigners but you will often be able to talk them down to 50% or even 75% off the initial price. Always haggle in an open marketplace with a vendor. I also recommend shopping around before buying to get the best price. This will save you money while traveling.

#2 Money Exchange

When I went no a trip to Argentina, we went with a travel group. My Spanish was not that great yet so I could not communicate past a 2nd-grade level. The travel guide met me at my hotel and informed me that I should only exchange money with Sergio, a trusted money exchanger, and look for a particular stamp (his identification) to determine if the currency was authentic.

I would see money exchange guys on the street but they “looked dangerous” (cloaked in black and wore wide-brimmed hats). I knew to stay away as soon as I saw them. They’ll usually offer a better rate to draw you in. Only exchange money at banks and with trusted individuals that your hotel or guides refer you to.

Related: AVOID Euronet ATMs While Traveling

#3 Don’t Trust All Hotel Booking Websites

I’ve booked a hotel on websites that offered no reviews because they had great prices. The photos looked decent and the area seemed promising. I get there to check-in and they don’t allow unmarried couples to stay in a room together. We get to the room and notice that the water bottle seals are broken. I don’t bother complaining because I already know the outcome. I go to the tiniest kitchen ever and see the UV filter crawling with roaches. Needless to say, I never booked on that website again.

We booked on Agoda the next time and had an excellent experience. The room a little more expensive, but the area was well maintained and there were plenty of restaurants in the area. Agoda offers real-life reviews from people who have booked and stayed at the hotels. Hotel guests also have the option to post photos from their stay. Agoda is a sister company of Booking.com and also works worldwide.

#4 Always Have Travel Insurance

I have always traveled with a credit card offering travel insurance. The one credit cards I use and recommend is Chase Sapphire Reserve (CSR).

On my trip to Seoul, South Korea, I somehow booked my ticket with the wrong birthdate. My partner had booked the same flight with the accurate birthdate. At the check-in counter, the agent stated that because I booked a child’s ticket, they would have to charge me an additional $300 to change the flight to an adult ticket.

I thought that was absurd because my partner paid the same price and his ticket was not a child’s ticket. I was on the phone with my CSR representative for 25 minutes and needed to board in 15 minutes. The CSR agent advised me to pay the difference and they would refund me. Their level of customer service surprised me and I literally burst into tears of joy.

Eventually, the agent said that I did not have to pay additional

#5 Withdrawing Money from ATMs

On my first trip abroad, I was unaware of foreign transaction fees. I also barely had any money in my bank account. What was I thinking while traveling abroad? I was very eager to see the world and this was before you could ask the internet for advice. I ended up overdrafting and paying even more fees. Most ATM fees ranged from $5-$8.50. The highest I experienced was in Chile for $8.50 per transaction.

I recommend getting a bank account that waives withdrawal and international ATM fees. Banks that I use to withdraw cash are Capital One and Charles Schwab. Try to use credit cards as often as you can and only use cash when necessary. I usually carry enough cash so that I spend no more than $50 per day if necessary.

#6 Foreign Transaction Fees

Foreign transaction fees (FTF) can add up. They seem minuscule while you’re buying things here and there but the average ~3% FTF will add up and that is money that you could have saved or spent elsewhere during your vacation. FTFs are usually hard to identify on your statements until you open up the transaction details of your monthly statements.

Credit cards that have no FTFs or annual fees that I recommend include:

- Capital One Quiksilver and

- Discover Card (however this card is not accepted everywhere)

Here are credit cards that come with an annual fee and have no FTFs that I recommend are:

- Chase Sapphire Reserve ($450 annually)

- Chase Sapphire Preserve ($95 annually)

- Alaska Airlines ($75 annually but comes with a $99+taxes companion fare that renews annually)

#7 Scammers Who Will Sell You Anything

Always be on the lookout for people trying to take advantage of you. We went on a Klong boat ride in Bangkok, Thailand for $27 USD (and this with the generous discount given to us by the operator). We then later found out they were offering official boat rides for only $4 USD elsewhere.

You can read more about the klong boat scam.

#8 Miscalculate the Exchange Rate

My partner and I were recently in Costa Rica. He gave $30 USD instead of $10 in tips to our ziplining team. I am pretty sure they celebrated later that day.

When denominations start to convert to the 100s and 1000s, it’s time to get really good at math or find a conversion method that is easy for you to apply and use throughout your trip.

I recommend the following currency conversion apps:

- CalConvert

- XE Currency (iOS and Android)

- My Currency Converter

#9 Giving Money to Homeless People

This is a tough one because giving feels good, however, are you just perpetuating a system that if indefinitely flawed? My answer here is both yes and no. I recommend taking in a person’s behavior while begging. Some people beg to support a bad habit, some resell merchandise that is given to them.

I NEVER give money to people who are begging or homeless. Instead, I donate to charities such as UNICEF, a local charity, or volunteer my time in the countries I visit. Most organizations require weeklong commitments while volunteering.

Make sure you reach out to the organizations before showing up to volunteer. Many of them have a formal training process and required a minimum commitment for volunteering.

#10 Pickpocketing

Luckily this has not happened to me. I have had friends experience their backpacks getting slashed, and people stealing wallets and cameras from right under their noses.

How do you prevent this?

- Research and area to see if its a problem there. Believe it or not, visitors to the US believe that pickpocketing is rampant everywhere in the states. Residents here believe it’s only in really rundown areas. If an area is prone to pickpocketing. Be VERY alert in these areas.

- If you have a backpack, wear it in front.

- If you have a crossbody, make sure it’s zipped all the way and fits snug against your body. Wear it under clothing if possible.

- Don’t wear flashy jewelry that people may think is valuable. My friend had some cheap jewelry yanked off her necklace by a child in Brazil.

- Notice odd behavior from strangers. If a group of people are purposely distracting and bothering you, they’re probably up to no good. Pickpocketing can happen one on one or in groups.

#11 Have an International Phone Plan

NEVER travel without a phone plan and data. If anything happens, you can call someone for help. Always learn the emergency phone numbers in a particular country and save it into your phone as a favorite contact. Also, alert family members and friends when you travel solo.

If you’re visiting the US, you should get a SIM from Net10 Wireless sent to your hotel or AirBnB. You can pay monthly and a month’s worth of data and calling is only $30 USD. Net10 only sells prepaid plans and can be canceled anytime.

#13 Always Put Your Valuables in the Safe

If your unit has a safe in it, use it. Never leave valuables out, even if the hotel is a fancy upscale one. Make it a habit to keep things that may seem desirable away from strangers. Make an effort to not lose your valuables abroad as you would at home.

#14 Watch for Holiday or Weekend Pricing

We dined at a restaurant during Chuseok (Korean Thanksgiving Holiday) and did not realize a restaurant charged us holiday pricing for an all-you-can-eat (AYCE) buffet. We ended up paying $5 more than usual.

We did not mind paying but wish we had known this custom beforehand.

#15 Be Aware of Different Menus

Different menus? What is this?

In Italy, I was given a menu for sit down service. I noticed the prices were higher than what I had read on the internet. I decided to ask the employees if they had another menu. They handed me a standing menu. The prices were 20% less and much more similar to the pricing I found online.

I realized there was a difference between standing and eating your food in an establishment. I thought that was odd but it saved me money throughout my trip.

#16 Be Conscious of Tipping Customs

In the US it is customary to tip 15-20% based on the quality of service. Tipping abroad can be a little trickier.

In Costa Rica, most places included tips or propinas (Spanish) in the final check. There is no need to tip more.

In some countries such as South Korea, Japan, Italy, and China it is rude to tip. In certain countries, the included service charge is considered generous and any more will confuse the employee and cause issues with restaurant owners in determining how additional tip should be split.

Most of the time restaurant owners will keep the additional tip, especially if you’re adding it to a credit card statement.

Final Thoughts

Money mistakes happen and it’s one of my favorite lessons in life. It reminds me that cultures are all different and it’s worth it to learn one another customs prior to traveling. This prepares us for dealing with cultural differences and even teaches us empathy when in a foreign place.

What is your biggest travel money mistake? What would you have done differently while traveling if you had the chance? I’d love to hear about your travel woes! Feel free to leave them in the comments section.

Thanks for reading!

Join Alex and Larry on our journey, as we find love, eat great food, and travel to beautiful destinations. #weloveeattravel